Recent Articles

City council unanimously endorses Brampton 2040 Vision

City council unanimously endorses Brampton 2040 Vision

Brampton City Council voted unanimously to endorse a new plan to transform the city over the next 22 years. The plan, Brampton 2040 Vision, was presented by urban planner Larry Beasley at a council meeting Monday night. His plan calls for a dramatic re-imagining of Brampton’s streets, economy, transit network and green spaces. Beasley, the former chief planner of Vancouver, was hired to create the plan last May.

CBC – Toronto Star – in Brampton

Times Group acquires Toronto Hydro’s North York site

It took five years to sell, but Toronto Hydro has finally managed to unload the former headquarters of North York Hydro in a deal that also illustrates the value of zoning density in the city. Toronto Hydro sold the 8.1-acre site at 5800 Yonge St. to condominium developer Times Group Corporation for $122.2 million. Across the street, similarly sized 8.6-acre Newtonbrook plaza cost Hong Kong-based Aoyuan Properties $200.8 million in 2017.

65-storey office tower planned for Quebec City

Groupe Dallaire’s proposed 65-storey Le Phare de Québec office tower complex in Quebec City will spur new development in the city’s Laurier Boulevard area, say the architects behind the $650-million project. The mixed-use project includes an 800-foot office tower that would become the tallest office building in Canada outside of Toronto.

ICM predicts Calgary rebound, invests in apartment build

ICM Group, an international asset management firm, has partnered with Alberta-based PK Developments and Providence Group to build a 135-unit apartment complex in Marda Loop, one of Calgary’s inner-city neighbourhoods. John Courtliff, ICM’s managing director, said Alberta’s economy is recovering and the company intends to pursue further opportunities to acquire or invest in what it considers to be quality real estate assets in the province.

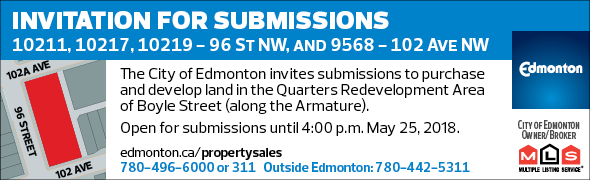

Proposals roll in for redevelopment of Edmonton lands

The City of Edmonton is no longer taking requests for ideas to redevelop Edmonton Exhibition Lands after receiving 62 submissions. The city generated ideas from the public to work on a plan to redevelop the land where Northlands Coliseum currently sits closed. They received 12 formal submissions and 50 submissions through their web portal.

Ottawa casino expansion a go despite concerns

A $318-million casino expansion at the Rideau Carleton Raceway will proceed, with construction on the south-end entertainment district set to begin this summer. Ottawa city council approved the Hard Rock Casino proposal Wednesday by a vote of 18-5. It includes an eight-storey hotel and a 2,500-seat concert venue.

Winnipeg’s downtown Richardson Innovation Centre unique

A downtown Winnipeg development by agricultural giant Richardson International Ltd., will transform two unsightly surface parking lots into what is hoped will serve as a beacon for innovation in the city. Last month, Richardson unveiled plans for its 62,000-square-foot, four-storey Richardson Innovation Centre. Costing $30 million and located just south of the city’s historic Exchange District, the development aims to spark another economic revolution in Winnipeg’s downtown.

Anbang founder sentenced to 18 years for fraud

A court in Shanghai sentenced the founder of a Chinese insurance company that owns extensive assets in B.C. to 18 years in prison on Thursday after he pleaded guilty to fraudulently raising billions of dollars from investors, state media reported. Shanghai’s No. 1 Intermediate People’s Court also ordered the confiscation of $1.6 billion Cdn in assets from Wu Xiaohui, the former chairman of Anbang Insurance Group.

CBC – Reuters – South China Morning Post – Vancouver Sun

Granite acquires $296M distribution facilities portfolio

Granite REIT (GRT-UN-T) Thursday announced it has agreed to acquire a portfolio of four class-A, single-tenanted buildings totalling approximately 3.8 million square feet on 78 acres of land near Columbus, Ohio at a purchase price of $296 million Cdn. The buildings are modern e-commerce distribution facilities with an average age of approximately seven years and are 100% occupied. Tenants in two of the buildings have expansion options of at least 200,000 square feet.

Canada Newswire – Property Biz Canada

RBC’s Neil Downey bids farewell to CREIT

Neil Downey, managing director of global research at RBC Capital Markets, said goodbye to an old friend this week, when Choice Properties REIT (CHP.UN-T) and CREIT (REF.UN-T completed the plan of arrangement that will see the merged entity become what he calls “Canada’s premier diversified REIT.” That merger marks “the end of an era for CREIT as a standalone entity,” after it was taken public almost 25 years back, Downey said.

Financial Post – Property Biz Canada

The many goings on at Pure Multi-Family REIT

If and when a sale occurs at Vancouver-based Pure Multi-Family REIT LP (RUF-UN-X), a group of insiders could be the big winners. The company announced a strategic review early last month in response to two acquisition proposals from the same suitor, but shareholders have been at odds with each other ever since. That insider-enriching possibility emerges from information contained in the 64-page circular prepared for the upcoming annual meeting, an event that may get more interesting.

Financial Post – Property Biz Canada

Cara taps turnaround specialist as CEO

Five years into the Prem Watsa era at Cara Operations Ltd. (CARA-T), the company is turning to a new chief executive – one who happens to be a turnaround specialist. Coupled with Cara’s acquisition of Keg Restaurants Ltd. in January, the appointment of Frank Hennessey signals a new chapter in the restaurant owner’s attempted rebound.

Globe and Mail (Subscription required) – Canada Newswire

CEO Neil Bruce says SNC-Lavalin is back on track

There may have been no worse time to join SNC-Lavalin Group’s (SNC-T) executive ranks than 2013, when the venerable Montreal-based engineering and construction firm was embroiled in a shocking bribery scandal. That’s when Neil Bruce came aboard as head of the resources and mining division. With a 30-year career at various energy and infrastructure companies, Bruce could have taken a job almost anywhere, but he chose embattled SNC.

Globe and Mail – Canada Newswire

OMERS Ventures expanding to London, Singapore

OMERS Ventures, the investment arm of Canadian public pension fund OMERS, has announced plans to open offices in London and Singapore to expand its global footprint beyond North America and into the European and Asian markets. OMERS invests and administers pensions for almost half a million active, deferred and retired employees of nearly 1,000 municipalities, school boards, libraries, police and fire departments, and other local agencies in communities across Ontario.

Amid thaw, Chinese eye North Korea real estate

Chinese property speculators are starting to bet on a rapid improvement in relations between North Korea and the rest of the world, pushing up prices in the border city of Dandong and even spurring buying interest in the world’s most isolated country. Last week, online Chinese real estate investment platform Uoolu.com released a guide for Chinese buyers interested in North Korean real estate.

Market Trends and Research

How industrial became CRE financing’s sweetheart

Over the last few years, industrial properties have risen through the ranks among banks and other commercial real estate lenders to become financing’s new sweetheart property type. These include core market warehouse and distribution centers, refrigeration/cold storage centers, flex buildings, manufacturing properties and R&D facilities.

National Real Estate Investor – Commercial Observer

What comes after co-working?

As an entrepreneur, I spend a lot of time thinking about the future and how my business and industry will be impacted by trends that are only just beginning to surface. In the commercial real estate industry, 2017 was a significant year for the co-working segment. But I believe there is an industry shift happening most people are not seeing.

U.S. banks loosen CRE lending standards

Banks eased standards on commercial real estate loans for the first time in almost three years, according to the Fed’s quarterly survey of senior loan officers, released on Tuesday. Over the past year, banks eased important lending terms — including maximum loan size and the spread of loan rates over their cost of funds — on construction and land development loans, nonfarm nonresidential loans and multi-family loans.

Real Estate Companies

JLL doubling down on growing capital markets business

Robust capital markets activity helped drive strong earnings and revenue growth for Jones Lang Lasalle Inc. in the first quarter, the global real estate firm reported Tuesday. Net income attributable to common shareholders was $40.3 million, compared with $7.2 million in the first quarter last year, and adjusted EBITDA increased 51 per cent to $107.7 million.

Brookfield, Investa lodge plans for Aussie office building

Brookfield Office Properties (BPO-PR-K-T) and Investa Office Fund have lodged plans with the City of Sydney council for a $52-million Cdn building at 388 George Street, adding to the changing face of the Sydney CBD’s northern end. Brookfield and Investa, who co-own the entire 36,000-square-foot block, are looking to build a new five-storey retail and commercial podium on the underutilised forecourt.

REOC Financial Reports

Latest financial results:

* Brookfield Asset Management Inc., (BAM-A-T), Globe Newswire

* Chartwell Retirement Residences, (CSH-UN-T), Canada Newswire

* Fiera Capital Corporation, (FSZ-T), Canada Newswire

* Firm Capital Property Trust, (FCD-UN-X), Globe Newswire

* Sienna Senior Living Inc., (SIA-T), Globe Newswire

* Tricon Capital Group Inc, (TCN-T), Canada Newswire

REIT Financial Reports

Latest financial results:

* AHIP REIT, (HOT-UN-T), Canada Newswire

* Artis REIT, (AX-UN-T), Canada Newswire

* Crombie REIT, (CRR-UN-T), Canada Newswire

* Dream Global REIT, (DRG-UN-T), Globe Newswire

* Dream Office REIT, (D-UN-T), Globe Newswire

* Killam Apartment REIT, (KMP-UN-T), Globe Newswire

* Maplewood International REIT, (MWI-UN-X), Globe Newswire

* Northview Apartment REIT, (NVU-UN-T), Globe Newswire

* Partners REIT, (PAR-UN-T), Globe Newswire

* Plaza Retail REIT, (PLZ-UN-T), Canada Newswire

* Pure Multi-Family REIT, (RUF-U-X), Canada Newswire

* SmartCentres REIT, (SRU-UN-T), Globe Newswire

* True North Commercial REIT, (TNT-UN-T), Canada Newswire

* WPT Industrial REIT, (WIR-U-T), Globe Newswire

Retail

METRO completes Jean Coutu Group acquisition

METRO INC. (MRU-T) announced today it has completed the $4.5-billion acquisition of The Jean Coutu Group (PJC) Inc. With this acquisition, the Jean Coutu Group becomes a wholly owned subsidiary of METRO, combining all its pharmacy operations. “We are very proud to have acquired Quebec’s top player in the pharmacy sector,” said Eric La Flèche, METRO’s president and CEO.

Canadian Tire pays $1B for Teachers’ sportswear company

Canadian Tire (CTC-T) is buying Norway-based sportswear company Helly Hansen for nearly $1 billion. The iconic retailer said Thursday it will pay $985 million and assume $50 million of the debt of the Norwegian firm, which makes various types of clothes for active living and other outdoor gear. While based in Oslo, Helly Hansen is owned by the Ontario Teachers’ Pension Plan, which bought the chain in 2012.

CBC – CityNews – CTV – Canada Newswire

Restaurants and Eateries

Tim Hortons president trying to make amends

Tim Hortons (QSR-T) president Alex Macedo has been crisscrossing the country, meeting with thousands of franchisees in a bid to regain their trust and convince them the fast food giant is committed to improving its strained relationship with some owners. His tour comes after months of public sparring with a dissident franchisee group over everything from cost-cutting measures to delays in supply deliveries to a $700-million renovation plan.

Cannabis industry news

Name change reflects Liquor Stores’ ambition to dominate market

The name change of Liquor Stores N.A., which owns the Liquor Depot chain, to Alcanna this week represents the company’s intent to expand into the Canadian cannabis market alongside Aurora Cannabis, the second-largest cannabis grower in Canada. “They’re our business partner,” James Burns, vice-chair and CEO of Alcanna, told CBC News. “It gives us one of the top, most incredible-leading, fastest-growing cannabis producers in the world.”

CBC – Globe Newswire – Canada Newswire – Globe Newswire

New Development

Fonds immobilier, Cogir partner on UniCité mixed-used project

The Fonds immobilier de solidarité FTQ and Cogir Real Estate are partnering for the construction of a new rental residential project, UniCité, on Molson Street in the Montréal borough of Rosemont–La Petite-Patrie. The building will consist of 175 units and commercial space that will be occupied by an IGA supermarket. It will include 28 community housing units managed by a housing cooperative with the help of the social economy enterprise Bâtir son quartier.

Human Resources

Spire appoints Nordan director of Assets & Development

Spire Development Corporation is experiencing remarkable growth as they widen their focus into innovative residential development. Already established as a respected commercial real estate firm, they continue to explore unique opportunities across asset classes in Metro Vancouver and the Fraser Valley. With this strategic expansion underway, Spire welcomes industry veteran Doug Nordan to the team as Director of Assets and Development.

Invesque adds industry veteran Bryan Hickman

Invesque (IVQ-U-T) Wednesday announced the addition of Bryan E. Hickman as senior vice-president – Investments. Hickman brings a long history of healthcare real experience to Invesque. Most recently, Hickman was a vice-president – Investments at Welltower Inc. (WELL-N) where he was responsible for underwriting new investment opportunities and the asset management of a portfolio valued at approximately $4.5 billion.

Canada Newswire – Property Biz Canada

Other

|

RENX has surpassed 10,530 Twitter followers |

| Recent follower BlueSky Properties is a member of the Bosa Family companies. For five decades, the Bosa name has been synonymous with style, quality and extraordinary value. | |

| Follow RENXca, the most comprehensive news feed on Twitter for Canadian real estate professionals. |

Industry Events

Industry Events

-

Canada Real Estate Auction

Oct 22 2024

-

Calgary Real Estate Forum

Oct 29 2024

Calgary TELUS Convention Centre

-

Global Property Market

Dec 03 2024

Metro Toronto Convention Centre, South Building

-

Toronto Real Estate Forum

Dec 04 2024

to Dec 05 2024

Metro Toronto Convention Centre, South Building

-

MIPIM: The Global Urban Festival

Mar 11 2025

to Mar 14 2025

Palais des Festivals, Cannes, France