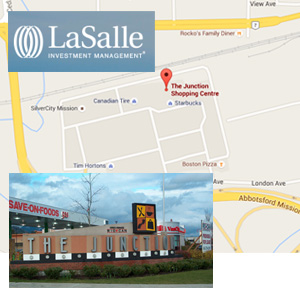

LaSalle Investment Management has a new plan for The Junction shopping centre in the District of Mission, B.C. after recently acquiring it on behalf of LaSalle’s flagship Canadian Income & Growth Fund IV (CIG IV).

The shopping centre was purchased from RioCan Real Estate Investment Trust and Kimco Realty Corporation for $68.05 million in April.

The shopping centre was purchased from RioCan Real Estate Investment Trust and Kimco Realty Corporation for $68.05 million in April.

“The Junction presented a unique opportunity for us to acquire a prominent, physically attractive and well-anchored retail asset within a fast-growing community,” said LaSalle senior vice-president Edmund Lee.

“While some more recent local developments have expanded the District’s retail footprint, The Junction remains at the commercial heart of Mission. From our analysis, it is evident that the centre has untapped potential that can be realized by focused local management and improved community engagement.”

Grocery-anchored shopping centre

The 282,533-square-foot, class-A shopping centre is near the intersection of Highways 11 and 7 in the Fraser Valley near Abbotsford and is 96-per cent occupied. It’s anchored by a Save-On-Foods grocery store and also includes London Drugs, SilverCity Mission Cinemas, Staples and GoodLife Fitness, among others.

“Our local team is excited about the opportunity to reposition The Junction as a premier retail destination serving Mission and the wider community,” said Lee.

“We have a number of leasing and community-oriented initiatives planned to achieve both short- and medium-term objectives that we’ve internally defined. After just a month of ownership, we’re pleased to announce that we’ve already reached a long-term renewal agreement with one of the anchor tenants and we are in discussion with a number of other retailers that will introduce new-to-the-centre goods and services for our customers and build on The Junction’s existing position as a needs-based centre serving the local community.”

LaSalle’s Canadian Income & Growth Fund IV

The Junction matches the acquisition criteria for CIG IV, which invests in office, industrial, retail and multi-family products across the country.

“LaSalle Investment Management’s strategy for CIG IV, a value-add fund, is to acquire properties with solid income characteristics that have the potential to be improved through active asset management,” said LaSalle’s managing director for Canada, Zelick Altman. “In addition, we seek to acquire properties that diversify the fund across both geography and asset type.

“With The Junction’s potential to add value through leasing and development opportunities, the property is an excellent fit for the CIG IV fund. Its strategic location in the Greater Vancouver area, a target market for us, helps increase our geographic diversification and adds an additional key property to the CIG IV’s retail allocation.”

LaSalle is a wholly owned, operationally independent subsidiary of real estate company Jones Lang LaSalle Inc. The real estate investment manager has approximately $58 billion of private and public equity and private debt investments under management. Its clients includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from around the globe.

LaSalle’s 2016 international acquisitions

In addition to its most recent Canadian purchase, LaSalle has made several major international acquisitions this year. They include:

- the UK Private Residential Fund acquiring 270 purpose-built residential units in Leeds and London in separate transactions for £55 million;

- the Alto Development Project in Paris, France in La Défense, Europe’s largest purpose-built business district, with a total development value of 320 million Euros, on behalf of a Middle Eastern sovereign wealth fund;

- an office building and car park in Munich, Germany for a figure in the two-digit-million Euro range on behalf of French public service additional pension scheme ERAFP;

- a long leasehold interest in 603 build-to-rent apartments at Nikal’s Exchange Square in Birmingham, England for more than £100 million on behalf of a client;

- Chicago mixed-use property Blackhawk on Halsted’s acquisition from Structured Development on behalf of Bavarian doctors’ pension fund Bayerische Ärzteversorgung;

- the Eurocenter II office building in Amsterdam’s central business district, which was acquired from Stichting Philips Pensioenfonds for an undisclosed sum on behalf of the pan-European fund Encore+, which it co-manages with Aviva Investors;

- and three retail and office buildings in Prague, Czech Republic acquired on behalf of ERAFP from a private owner for approximately 80 million Euros.